ISM Indexes Watch for Trouble on Both Sides of the Economy

Economists and investors pay attention to the Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) not only for information about the health of U.S. factories but also for clues about demand in the national economy. A reading below 50% generally means that manufacturing activity is contracting, and a reading below 48.7% indicates that the overall economy is contracting along with it.

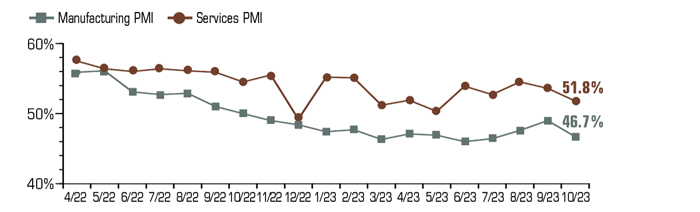

In October 2023, the Manufacturing PMI registered a disappointing 46.7%. It was the twelfth consecutive month of contraction.1 Manufacturers faced pricing pressures due to inflation, while rising borrowing costs cut into customer demand.2

Two types of business activity

The ISM has two different composite indexes (Manufacturing PMI and Services PMI), each calculated from corresponding report data. Both monthly reports are based on recent data from surveys of hundreds of purchasing and supply executives nationwide.

The Manufacturing PMI follows changes in production, new orders, employment, supplier deliveries, and inventories from month to month. It represents current business conditions for the overall manufacturing sector, which ISM breaks down into distinct industries and weights according to their contribution to gross domestic product (GDP). The six largest subsectors are Computer & Electronic Products; Chemical Products; Food, Beverage & Tobacco Products; Transportation Equipment; Machinery; and Petroleum & Coal Products.

The Services PMI tracks business activity, new orders, employment, and supplier deliveries for the service sector. The biggest players among the ISM’s service industries are Real Estate, Rental & Leasing; Government; Professional, Scientific & Technical Services; Health Care & Social Assistance; Information; and Finance & Insurance.

Manufacturing contractions have often preceded recessions — but they don’t always mean an economic downturn is imminent. There have been times (most recently in 2016 and 2018) when growth in the much-larger services sector has helped the U.S. economy weather periods of weakness in manufacturing. In contrast to the Manufacturing PMI, the Services PMI signaled expansion (51.8%) for the tenth straight month in October 2023.3

Both ISM indexes are widely followed because they are generally considered to be leading economic indicators that can help businesses and investors make more informed decisions. Increases are often regarded as good news because they point to the potential for faster economic growth, larger corporate profits, and higher stock prices, but the reverse is also true for index declines. As a result, the financial markets may overreact to positive or negative reports, especially when the results are surprising.

Indexes Agree to Disagree on Growth

In 2023, the Manufacturing PMI and Services PMI seemed to predict different fates for the U.S. economy.

Source: Institute for Supply Management, 2023

Supply chain reshoring

Expanding globalization has changed the structure of the U.S. economy since the late 1970s, when manufacturing accounted for about 21% of the U.S. GDP. Factory production is now a smaller part of the U.S. economy — roughly 11% of GDP — and it employs fewer workers than it did in the past.4 The number of U.S. manufacturing employees peaked at about 19.5 million in 1979, and decreased to 13 million by the beginning of 2023.5

The offshoring of production to China and other countries with cheaper labor, and investment in new industrial technology (including automation) are common business practices that reduce the ranks of factory workers in America.

However, the pandemic exposed vulnerabilities in global supply chains, prompting many businesses to move some production back to the United States, a trend called reshoring. And some industries (such as semiconductors and batteries) have been offered federal subsidies to help build costly new facilities in the United States. In 2022, companies were expected to reshore an all-time high of nearly 350,000 jobs, up from 265,000 in 2021 — and more than 50 times the amount (6,000) in 2010.6

All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful. Projections are based on current conditions, are subject to change, and may not come to pass.

1, 3) Institute for Supply Management, 2023

2) Reuters, May 1, 2023

4) U.S. Bureau of Economic Analysis, 2023

5) U.S. Bureau of Labor Statistics, 2023

6) The Wall Street Journal, August 23, 2023

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek guidance from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2023 Broadridge Financial Solutions, Inc.

Rudy Rodriguez is insurance licensed in the states of GA and FL. Stuart Jones is insurance licensed in the states of AL, FL, GA, IL, MD, MS, NY, SD, TN, TX and VA. Kinship Wealth Partners offers advisory Services through EPG Wealth Management LLC, an SEC Registered Investment Adviser. Securities offered through Arkadios Capital, a broker/dealer, Member FINRA/SIPC. Kinship Wealth Partners, EPG Wealth Management LLC, and Arkadios Capital are not affiliated through any ownership. Certain individuals associated with or employed by Kinship Wealth Partners, may be registered with EPG Wealth Management LLC and/or Arkadios Capital. Past performance does not guarantee or is indicative of future results. This summary of statistics, price, and quotes has been obtained from sources believed to be reliable but is not necessarily complete and cannot be guaranteed. All securities may lose value, may not be insured by any federal agency and are subject to availability and price changes. Market risk is a consideration if sold prior to maturity. Information and opinions herein are for general informational use only and subject to change without notice. This material does not constitute an offer to sell, solicitation of an offer to buy, recommendation to buy, or representation as the suitability or appropriateness of any security, financial product, or instrument, unless explicitly stated as such. Link to SIPC https://www.sipc.org/ Link to FINRA https://brokercheck.finra.org/ Privacy Policy SIPC FINRA ADV Brochure