It’s Your Money: Why Not Get Your Tax Withholding Right?

The IRS issued about 95 million federal income tax refunds by May 12, 2023 (for tax year 2022), averaging $2,812.1 You might consider this type of windfall a stroke of good fortune, but is it really? You probably wouldn’t pay someone $234 each month to receive $2,812 back at the end of a year. But that’s essentially what a tax refund is — the repayment of your interest-free loan to the government.

If you received a large refund on your 2022 return, consider reducing your federal income tax withholding, which would leave you with a bigger paycheck. Taking home more of your pay may let you put that money to better use. For example, you may be able to pay off credit-card debt sooner, build up your emergency savings, or contribute more to a retirement account. If your tax bill was higher than you expected and you had to scramble for the money to pay it, bumping up your withholding might help you avoid a similar situation next April.

In any case, it’s a good idea to check your withholding periodically. This is particularly important when something changes in your life; for example, if you move, get married, divorce, or have a child; you or your spouse change jobs; or your financial situation changes significantly. The IRS has an online tool (the Tax Withholding Estimator) that can help you determine whether — and how much — to adjust your withholding.

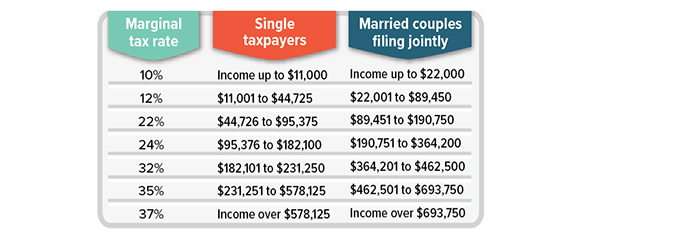

Federal Tax Brackets for 2023

The amount of federal income tax withheld from each paycheck is based on the information on your W-4 Form, which may have been filled out a long time ago. If you decide to make an adjustment, you will need to complete a new W-4 and submit it to your employer.

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek guidance from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2023 Broadridge Financial Solutions, Inc.

Rudy Rodriguez is insurance licensed in the states of GA and FL. Stuart Jones is insurance licensed in the states of AL, FL, GA, IL, MD, MS, NY, SD, TN, TX and VA. Kinship Wealth Partners offers advisory Services through EPG Wealth Management LLC, an SEC Registered Investment Adviser. Securities offered through Arkadios Capital, a broker/dealer, Member FINRA/SIPC. Kinship Wealth Partners, EPG Wealth Management LLC, and Arkadios Capital are not affiliated through any ownership. Certain individuals associated with or employed by Kinship Wealth Partners, may be registered with EPG Wealth Management LLC and/or Arkadios Capital. Past performance does not guarantee or is indicative of future results. This summary of statistics, price, and quotes has been obtained from sources believed to be reliable but is not necessarily complete and cannot be guaranteed. All securities may lose value, may not be insured by any federal agency and are subject to availability and price changes. Market risk is a consideration if sold prior to maturity. Information and opinions herein are for general informational use only and subject to change without notice. This material does not constitute an offer to sell, solicitation of an offer to buy, recommendation to buy, or representation as the suitability or appropriateness of any security, financial product, or instrument, unless explicitly stated as such. Link to SIPC https://www.sipc.org/ Link to FINRA https://brokercheck.finra.org/ Privacy Policy SIPC FINRA ADV Brochure