Managing Medicare Out-of-Pocket Costs

Medicare covers only 60% of total health-care costs for Americans age 65 and older.1 Deductibles, copays, coinsurance, and payments for services not covered by Medicare can result in substantial out-of-pocket expenses. And there is no annual or lifetime out-of-pocket limit.

Whether you are already enrolled in Medicare or planning to enroll in the future, you may want to consider two options to help manage out-of-pocket costs: Medigap and Medicare Advantage. Both are offered by private insurance companies approved and regulated by Medicare. They are mutually exclusive — you cannot be covered by both — but either might provide more stability to your health-care spending in retirement.

Supplemental Insurance

Medigap supplements coverage under Original Medicare Part A (hospital insurance) and Part B (medical insurance), and you must be enrolled in Part A and Part B in order to buy a Medigap policy. These policies pay nearly all or a percentage of Medicare out-of-pocket costs such as deductibles, copays, and coinsurance. Some plans may pay for services not covered by Medicare, such as emergency medical care outside the United States (up to plan limits), but they generally do not cover long-term care, vision or dental care, hearing aids, or private-duty nursing. New Medigap policies do not cover prescription drugs, so you must enroll in Medicare Part D if you want prescription drug coverage.

You can enroll in a Medigap plan at any time, but the best time to do so is during the initial Medigap open enrollment period — the six-month period that begins on the first day of the month in which you are 65 or older and enrolled in Medicare Part B. During this time, you can buy any Medigap policy in your state for the same premium the insurance company charges to healthy enrollees, even if you have health problems. If you miss this opportunity, a company can charge you more for coverage or refuse coverage altogether, depending on your health. Medigap policies are guaranteed renewable; once you are enrolled, you cannot be denied coverage or charged more than healthy enrollees due to changes in your health, as long as you pay your premium.

A Medigap policy covers only one individual, so you and your spouse need separate policies if you both want coverage.

Saving for Retirement Health Care

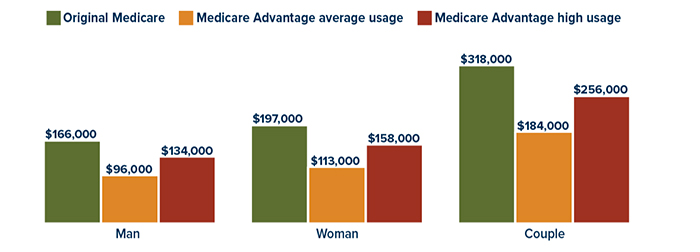

This chart shows the savings that a man, a woman, and a couple who retired at age 65 in 2022 might need to meet retirement health-care expenses, assuming median prescription drug expenses. Medicare Advantage Plans can reduce out-of-pocket expenses, but they often have limited networks and may require approval to cover certain medications and services. Source: Employee Benefit Research Institute, 2023. Projections are based on a 90% chance of meeting expenses and assume savings earn a return of 7.32% from age 65 until expenditures are made. Does not include vision, hearing, dental, or long-term care expenses. Original Medicare estimate includes premiums for Medicare Parts B and D, the Part B deductible, out-of-pocket prescription drug spending, and premiums for Medigap Plan G, which would pay most other out-of-pocket costs. Some Medicare Advantage Plans require additional premiums, which are not included.

Source: Employee Benefit Research Institute, 2023. Projections are based on a 90% chance of meeting expenses and assume savings earn a return of 7.32% from age 65 until expenditures are made. Does not include vision, hearing, dental, or long-term care expenses. Original Medicare estimate includes premiums for Medicare Parts B and D, the Part B deductible, out-of-pocket prescription drug spending, and premiums for Medigap Plan G, which would pay most other out-of-pocket costs. Some Medicare Advantage Plans require additional premiums, which are not included.

All-in-One Coverage

Medicare Advantage (MA) Plans, also called Medicare Part C, replace Original Medicare Part A and Part B and often offer prescription drug coverage, similar to Medicare Part D. Benefits are provided through a private insurance company, but much of the funding comes from the federal government, and plans must offer the same benefits as Original Medicare.

MA plans generally encourage the use of network providers and have higher costs for out-of-network services. They may offer additional benefits not covered by Original Medicare, such as dental care, eyeglasses, and wellness programs. You will typically pay your Medicare Part B premium and may pay an additional premium, depending on the plan. You may also have out-of-pocket deductibles, copays, and coinsurance. However, all MA plans have an annual out-of-pocket maximum.

You can enroll in an MA plan instead of Original Medicare during your initial Medicare enrollment period.2 You can change coverage from Original Medicare to MA or vice versa, or change between MA plans, during the Medicare Open Enrollment period from October 15 to December 7. You can change from MA to Original Medicare or switch MA plans during the Medicare Advantage Open Enrollment period from January 1 to March 31. You may also be able to make changes during other special enrollment periods.

For more information on Medigap, Medicare Advantage, and enrollment periods, see Medicare.gov.

This means that investors might be able to tap into the higher yields being offered on muni bonds without taking on greater risk. The yield on the Bloomberg Muni Benchmark 30Y Index, a common benchmark, rose to 3.6% at the end of 2022, after starting the year at just 1.5%.3

Accounting for Taxes

The interest paid by municipal bonds is generally exempt from federal income tax, as well as from state and local taxes if the investor lives in the state where the bond was issued. For this reason, muni bonds and tax-exempt funds have long been a mainstay in the portfolios of income-focused investors who want to manage their tax burdens.

The taxable equivalent yield is the pre-tax yield that a taxable bond must offer for its yield to be equal to that of a tax-exempt muni bond. Tax-free yields are often more valuable to investors in higher tax brackets, and they have become especially appealing in high-cost states now that the federal deduction for state and local taxes is limited to $10,000 a year.

For example, a 5% tax-free yield is equivalent to a taxable yield of about 7.9% for an investor in the 37% tax bracket and 6.6% for an investor in the 24% tax bracket. Exemption from state income taxes would increase the equivalent yield.

Investors should keep in mind that capital gains taxes could still be triggered if tax-exempt bonds or fund shares are sold for a profit. Also, tax-exempt interest is included in determining whether a portion of any Social Security benefit received is taxable. Some muni bond interest could be subject to the alternative minimum tax.

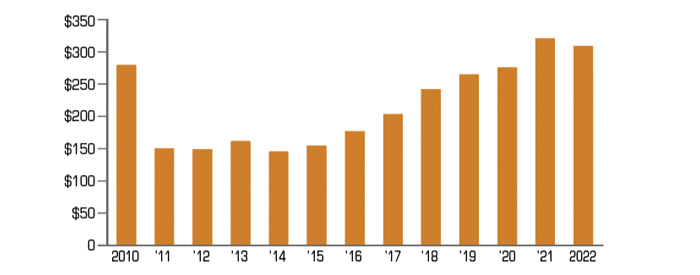

Municipal bonds issued for new projects, in billions

Source: Refinitiv, 2023

Reviewing the Risks

Because government entities have the power to raise taxes and fees as needed to pay the interest, muni bonds generally carry lower risk than corporate bonds. From 1970 through 2021, the 5-year default rate for U.S. municipal bonds was 0.08%, compared with 6.8% for global corporates.4

Regional economies and the financial strength of issuers can vary widely, so municipal issues are rated for credit risk, as are other bonds. A credit rating ranging from AAA down to BBB (or Baa) is considered “investment grade”; lower-rated or “high-yield” bonds carry greater risk.

As interest rates rise, bond prices fall, and vice versa. When redeemed, bonds may be worth more or less than their original cost. Bond funds are subject to the same inflation, interest-rate, and credit risks associated with their underlying bonds. The return and principal value of bonds and mutual fund shares fluctuate with changes in interest rates and other market conditions, which can adversely affect investment performance.

The performance of an unmanaged index is not indicative of the performance of any specific security. Individuals cannot invest directly in any index. Past performance is no guarantee of future results. Actual results will vary.

Mutual funds and ETFs are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek guidance from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2023 Broadridge Financial Solutions, Inc.

Rudy Rodriguez is insurance licensed in the states of GA and FL. Stuart Jones is insurance licensed in the states of AL, FL, GA, IL, MD, MS, NY, SD, TN, TX and VA. Kinship Wealth Partners offers advisory Services through EPG Wealth Management LLC, an SEC Registered Investment Adviser. Securities offered through Arkadios Capital, a broker/dealer, Member FINRA/SIPC. Kinship Wealth Partners, EPG Wealth Management LLC, and Arkadios Capital are not affiliated through any ownership. Certain individuals associated with or employed by Kinship Wealth Partners, may be registered with EPG Wealth Management LLC and/or Arkadios Capital. Past performance does not guarantee or is indicative of future results. This summary of statistics, price, and quotes has been obtained from sources believed to be reliable but is not necessarily complete and cannot be guaranteed. All securities may lose value, may not be insured by any federal agency and are subject to availability and price changes. Market risk is a consideration if sold prior to maturity. Information and opinions herein are for general informational use only and subject to change without notice. This material does not constitute an offer to sell, solicitation of an offer to buy, recommendation to buy, or representation as the suitability or appropriateness of any security, financial product, or instrument, unless explicitly stated as such. Link to SIPC https://www.sipc.org/ Link to FINRA https://brokercheck.finra.org/ Privacy Policy SIPC FINRA ADV Brochure